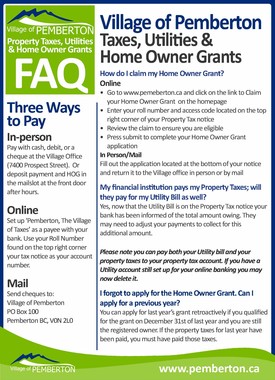

How Can I Pay my Property Taxes and Utilities?

There are three Ways to Pay!

In-person

Pay with cash, debit, or a cheque at the Village Office (7400 Prospect Street). Or deposit payment and HOG in the mailslot at the front door after hours.

Online

Set up ‘Pemberton, The Village of Taxes’ as a payee with your bank. Use your Roll Number found on the top right corner your tax notice as your account number.

Send cheques to: Village of Pemberton PO Box 100 Pemberton BC, V0N 2L0

How do I claim my Home Owner Grant?

Online

• Go to www.pemeberton.ca and click on the link to Claim your Home Owner Grant on the homepage

• Enter your roll number and access code located on the top right corner of your Property Tax notice • Review the claim to ensure you are eligible

• Press submit to complete your Home Owner Grant application

In Person/Mail

Fill out the application located at the bottom of your notice and return it to the Village office in person or by mail

My financial institution pays my Property Taxes; will they pay for my Utility Bill as well?

Yes, now that the Utility Bill is on the Property Tax notice your bank has been informed of the total amount owing. They may need to adjust your payments to collect for this additional amount.

Please note you can pay both your Utility bill and your property taxes to your property tax account. If you have a Utility account still set up for your online banking you may now delete it.

I forgot to apply for the Home Owner Grant. Can I apply for a previous year?

You can apply for last year’s grant retroactively if you qualified for the grant on December 31st of last year and you are still the registered owner. If the property taxes for last year have been paid, you must have paid those taxes.